Your First Home:

First-Time Homebuyers Start Here

Buying your first home can feel like stepping into a world of brand-new terms, big decisions, and questions you didn’t even know to ask. That’s where we come in.

At LUCAS Home Loans, we’re not here to push paperwork—we’re here to partner with you. From budgeting basics to understanding your credit score, we’ll help you build the knowledge and financial foundation to become a confident, successful homeowner for life.

Smart Budgeting for First-Time Buyers

Before you fall in love with a house, it’s important to fall in love with your budget.

We believe education is just as valuable as money, we also provide tools, content, and easy-to-follow guidance to help you make smart choices. Through our LUCAS app, you’ll get access to self-paced financial learning and budgeting tools that meet you where you are.

Learn with LUCAS

Get access to tools helping you build and maintain credit, manage finances, budget, and save to achieve their goals

- Improve your credit and debt ratio

- Personalized guidance to qualify for a mortgage

- Track the value of your home and investments

Renting Vs. Owning

Renting can feel like the safer option when you’re just starting out—but homeownership can be a powerful way to build stability and wealth over time.

Here’s the difference:Renting

- Monthly payments go to your landlord

- Rents can increase over time

- No equity or ownership

- Less responsibility for repairs

Owning

- Monthly payments build your equity

- Mortgage payments stay consistent (if fixed-rate)

- Your home can increase in value over time

- You're in control of your space and future

Credit 101:

What You Need

to Know

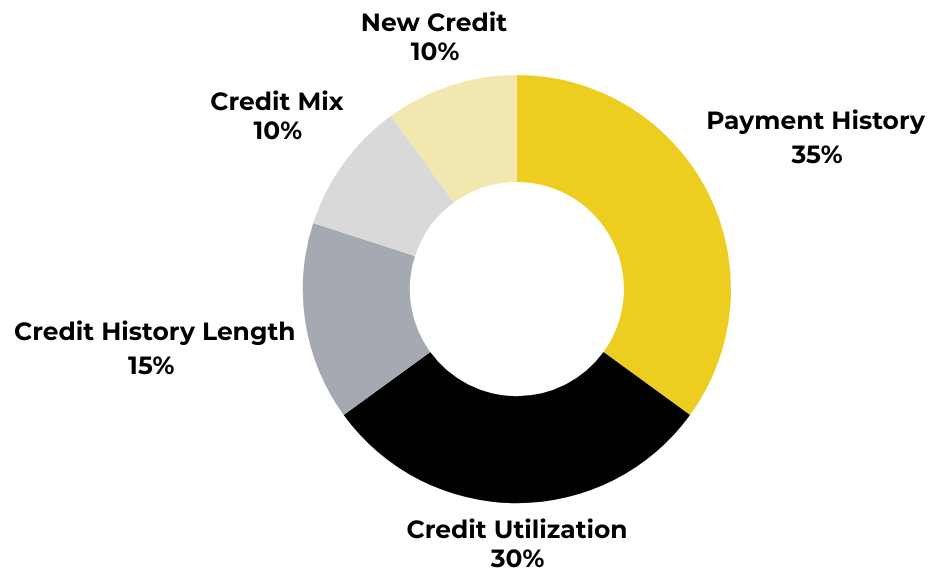

You don’t need a perfect credit score to buy a home—but your credit does play a big role in your mortgage options. The good news? We’re here to help you understand it and improve it if needed.

- Always pay bills on time—even minimum payments count.

- Keep credit card balances below 30% of your limit.

- Avoid opening too many new accounts at once.

- Don’t close old accounts unless you have to.

Down Payment vs. Closing Costs: What’s the Difference?

One of the biggest surprises for first-time buyers is learning that the down payment isn’t the only cost you’ll need at closing.

Down payment

This is your initial investment in the home—usually between 3% to 20% of the purchase price, depending on your loan type.

Closing Costs

These are fees for services related to your loan and home purchase—typically 2% to 5% of the home price. They may include:

- Appraisal & inspection fees

- Title insurance

- Taxes and government fees

- Prepaid interest

- Homeowner’s insurance

Smart Budgeting

Before you fall in love with a house, it’s important to fall in love with your budget.We believe education is just as valuable as money, we also provide tools, content, and easy-to-followguidance to help you make smart choices. Through our LUCAS app, you’ll get access to self-paced financial learning and budgeting tools that meet you where you are.

First-Time Homebuyer Do’s and Don’ts

We’ve worked with thousands of first-time buyers, and we’ve seen it all. Here’s what we recommend:

- Get pre-approved before you start shopping

- Ask away—there are no dumb questions

- Work with a homebuying team you trust

- Set realistic expectations and timelines

- Keep your finances steady during the process

- Make big purchases (cars, furniture, etc.)

- Open or close credit accounts suddenly

- Change jobs without talking to your lender

- Assume you need 20% down

- Skip the home inspection

You’ve Got This

We’re here to make homeownership not just possible, but powerful. Our goal isn’t just to help you buy a home—it’s to help you thrive in it.

And if you're not quite ready yet? That’s okay too. We’ll meet you where you are, with financial tools, expert guidance, and a plan for moving forward.

Let’s make this the start of something big.- Always pay bills on time—even minimum payments count.

- Keep credit card balances below 30% of your limit.

- Avoid opening too many new accounts at once.

- Don’t close old accounts unless you have