Whether you’re exploring your options or seriously considering a refinance, we’re glad you’re here. Refinancing is simply a way to reassess—an opportunity to align your mortgage with your current goals, financial situation, or future plans. Some people refinance to lower their monthly payment, access home equity, or shorten their loan term. Others are just here to learn what’s possible.

At LUCAS Home Loans, we’re here to guide—not pressure. We believe that when you understand your options, you’re empowered to make decisions that support long-term stability and wealth. That’s why we focus on more than just rates and paperwork—we focus on you. Through education and thoughtful support, our mission is to equip you with the tools to build financial confidence and create a stronger foundation for yourself, your family, and your community.

Why People Refi ?

There are a lot of reasons people choose to refinance, and all of them come down to one simple thing: making their money work smarter.

Here are a few common goals we help clients with:- Lower Your Monthly Payment – If interest rates have dropped or your credit has improved, refinancing could save you hundreds each month.

- Stabilize Your Loan– Swap out an adjustable-rate mortgage for a fixed-rate mortgage for dependable monthly payments.

- Tap into Home Equity – Access cash for home improvements, debt consolidation, or life expenses.

- Shorten Your Term – Pay off your home faster and save thousands in interest.

- Fix What Didn’t Feel Right the First Time – A refinance is a chance to reset—and do it on your terms, with more knowledge and control.

We’ll walk through your goals together and talk through all your options—clearly, patiently, and with zero pressure.

Refinancing, Step by Step

Just like buying a home, refinancing your mortgage is a process. But when you’re guided by a team that puts education and care first, it feels a lot less intimidating.

Start with a simple conversation. We’ll ask about your current mortgage, what’sworking (and what’s not), and what you’re hoping to accomplish.

A Better Mortgage Is

Just the Beginning

Refinancing isn’t just about numbers—it’s about peace of mind. And while the savings can be great, the best part might be the clarity, confidence, and long-term security you gain.

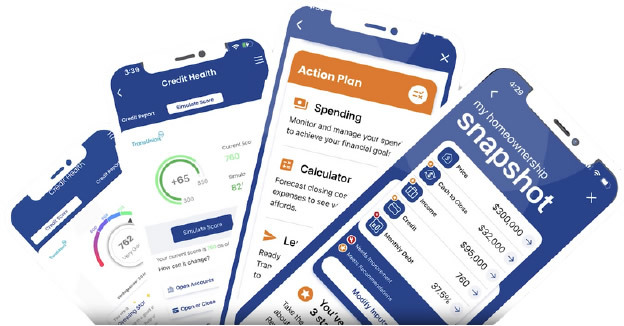

We’re committed to helping you succeed far beyond the loan paperwork. Through our LUCAS app, you’ll find:

- Self-paced financial education

- Budgeting tools

- Credit-building support

- Real answers to your important financial questions

Whether this is your first time refinancing or you’re just ready for a better experience, we’re here to walk it with you.

You're Not Stuck

You deserve to feel good about your mortgage. If it’s not serving you anymore, it’s okay to change it. If your last experience felt confusing, rushed, or just not right—we see you. And we’re here to do things differently.

Let’s talk about how we can improve your financial picture—without the stress.