Buying a home is more than a financial milestone—it's a life moment. At LUCAS Home Loans, we know it can feel overwhelming, especially if you're a first-time buyer. We're here to simplify the process and make it empowering—and maybe even exciting.

We believe homeownership builds long-term stability and generational wealth. Yes, we offer mortgage loans and down payment assistance. But more importantly, we provide education, tools, and encouragement to help you take control of your future.

It Just Takes A Plan

No two paths to homeownership look the same—and that’s a good thing. Whether you’re ready to buy soon or just starting to think about it, we’re here to help you create a step-by-step plan that fits your life. Some of our clients are a few weeks away from being ready, others take a year or more. Either way, we’ll guide you through the process so you can move forward with confidence.

Here’s how we help you build a plan:

- Review your full financial picture and set a realistic budget

- Understand how credit, debt, and income shape your buying power

- Break big goals into smaller, actionable steps

- Track your progress with tools that grow with you

- Get the support and encouragement you need, every step of the way

Buying a Home in 5 Simple Steps

Homeownership includes more than just your mortgage payment. Consider:

- Current Rent vs. Mortgage: Monthly payments may look different, and owningincludes additional costs.

- Utilities: Expect increases in water, gas, and electric.

- Maintenance: Plan to set aside 1% of the home’s value each year.

- Taxes & Insurance: Vary by location—important to budget for.

- Ongoing Expenses: Include car payments, childcare, student loans, etc.

- Emergency Fund: Aim for 3–6 months of living expenses for peace of mind.

Pre-approval shows how much you can borrow and sets realistic expectations. It factors in your credit score, income, and existing debts—plus down payment and closing cost estimates.

Just remember: being approved for a certain amount doesn't mean you have to borrow all of it.

Now you're ready to house hunt. Focus on what fits your lifestyle—location, space, schools, commute. A trusted real estate agent can help you navigate the market and stay aligned with your budget.

Once your offer is accepted, it's time to secure your loan. That includes finalizing your application, locking your rate, and preparing for closing costs (typically 2% - 6% of the home price).

At closing, you'll sign the paperwork, pay final costs, and receive the keys to your new home. But the journey doesn't end there—we're here for you with ongoing education, resources, and support.

Learn as You Go

Grow as You Know

You don’t need a massive savings account to get started. We offer down payment assistance programs that have already helped homebuyers unlock over $1 million in financing—and we’re just getting started.

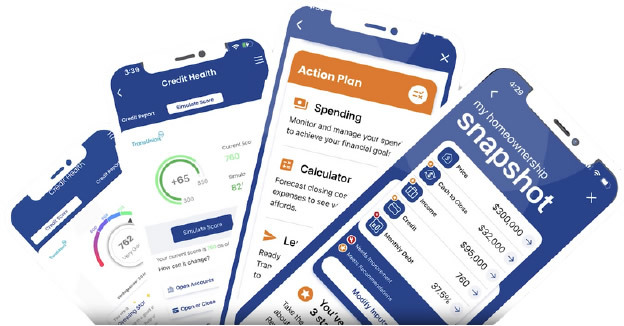

We believe knowledge is just as powerful as cash. That’s why our LUCAS app offers self-paced financial learning and budgeting tools designed to meet you where you are.

Learn with LUCAS

Access tools to help you build credit, manage your money, and stay on track toward your goals.

-

Understand & Improve Your Credit

Track your credit score, catch errors early, and see how actions like paying down debt could impact your score. -

Create a Budget That Works for You

Set goals, build a budget, and get insights based on your real spending—so you can save with purpose. -

Know What You Can Afford

Get a clear homebuying budget based on your income and expenses, and see what steps can help you qualify for a mortgage. -

Stay on Track with a Personalized Plan

Follow a customized action plan to reach your homeownership goals, whether you're starting fresh or almost there.

You’re Not Alone

You don’t need to come from wealth, have perfect credit, or know every mortgage term to buy a home. Our community is full of people who once thought homeownership was out of reach—now they’re thriving. And so can you.